The Real Impact of Veterinary Private Equity on Practice Owners and Exits

Veterinary private equity isn’t new. But the pace, pressure, and pitch have changed. Today, even mid-size clinics in second-tier cities are receiving unsolicited interest from funds that didn’t exist five years ago. Those calls come as quiet emails, through consolidators, or after a conference handshake.

Owners who’ve spent years building local trust are suddenly asked to think like portfolio founders. What’s your EBITDA? Are you a platform or a bolt-on? Will you stay post-close? And what’s your view on rollover equity?

It’s no longer just about selling. It’s about navigating an entirely different playbook, one where valuation is financialized, outcomes are staggered, and deals come with strings most sellers don’t fully see until after signing.

This blog explains what veterinary private equity means for owners: the upside, the trade-offs, and the questions no buyer will volunteer, but every vet practice owner should ask.

What is Veterinary Private Equity?

| Private equity in the veterinary space refers to investment firms (not operators or consolidators) acquiring practices using capital from outside investors. |

Private Equity (PE) firms aren’t buying clinics to run them indefinitely. They’re assembling portfolios designed to grow quickly, improve margin, and exit at a higher multiple than they entered.

So, the business you spent years refining is now being measured against timelines and targets that have nothing to do with your local market and everything to do with return on investment.

Not all PE deals are the same. Some involve full buyouts. Others require you to stay on for two or three years. Many split payment across upfront cash and backend performance. You may hear terms like “roll-up,” “bolt-on,” “earn-out,” or “platform multiple” and realize no one’s giving you the full picture unless you ask for it.

If you’ve been approached by a PE-backed group or are beginning to evaluate your options, understanding how these deals work under the hood is essential. You can explore a breakdown of how private equity is used in real veterinary transactions, right from deal structure to payout timing, in this owner-focused guide.

How Animal Health Private Equity Became a Driving Force in Clinic Growth

For most clinic owners, growth used to mean one thing: more clients, more staff, more responsibility. It was personal. It was earned. And it was slow.

Then, animal health private equity arrived with a different interpretation.

Instead of asking how a clinic grew, firms focused on whether growth could be engineered. That shift (subtle at first) is what turned PE into a dominant force in clinic expansion.

What Private Equity Saw That Owners Rarely Measured

From an operator’s seat, growth feels messy. From an investor’s lens, it’s measurable. PE firms noticed patterns many owners never had time to document:

- Clinics with similar revenue behaved differently under the same demand

- Margin expansion often came from systems, not services

- Multi-location performance smoothed risk, even when individual clinics fluctuated

Rather than betting on individual practices, firms began assembling networks that could absorb volatility and still grow. The growth wasn’t always visible at the clinic level, but it showed up clearly at the portfolio level.

This changed the power dynamic. And suddenly, growth wasn’t just about doing more. It was about being positioned correctly within a larger structure.

Why This Accelerated Buyer Activity

As PE-backed groups scaled, they created competition for growth-ready operators. That’s when outreach intensified. Owners who hadn’t considered selling started getting calls. Conversations shifted from “Are you interested?” to “When would you consider it?”

Understanding who’s buying veterinary practices and why their timelines differ helps explain how PE capital became so influential so quickly.

Why PE Firms are Buying Vet Clinics and What They Look For

Private equity firms buy vet clinics because the underlying economics are strong and scalable. That’s the part most clinic owners underestimate. The decision to acquire isn’t emotional, and it’s rarely impulsive. It’s a math exercise rooted in margin, retention, and the ability to control future cash flow.

What Makes Veterinary Clinics Attractive to PE

It’s not about charm. It’s about consistency. PE groups are drawn to the animal health space for five structural reasons:

| Factor | Why It’s Important to PE |

|---|---|

| Recurring revenue | Annual exams, vaccinations, and chronic care make revenue predictable |

| Fragmented market | Thousands of independent clinics = roll-up potential |

| Private pay model | No insurer bottlenecks or reimbursement lag |

| Scalable operations | Admin, tech, and procurement can be centralized |

| High emotional stickiness | Clients rarely switch clinics without a trigger |

But even with this macro attractiveness, not every practice gets a call.

What PE Firms Evaluate Before an Offer

Most groups are looking for multi-factor alignment, not just revenue size. What does that mean in practice?

- EBITDA quality and not just the top-line numbers

- Client base retention over time

- Owner dependency: Will the business survive if you step back?

- Operational messiness: Is your P&L clean enough to scale?

- Competitive moat: Can you be replaced by the clinic next door?

If your clinic checks the right boxes, you may qualify for premium valuation. If not, you’ll either get passed over or slotted into a lower-tier deal structure.

To see how price ranges vary based on these factors, this breakdown o how much private equity is paying for veterinary practices outlines the spread and why not all EBITDA is weighted equally.

How Private Equity Impacts Clinic Valuation and Deal Structure

Most clinic owners anchor on the top-line number when an offer comes in. For example, a “12x multiple” or a “$3.4M deal.” But that number only tells part of the story. What’s more important is how private equity structures the payout and what’s buried beneath the headline.

What’s Really Being Valued and How it’s Applied

When PE firms assess a practice, they’re not just valuing the current business; they’re pricing in what they can extract from it post-acquisition.

| Factor | Weight in Valuation | Why It’s Important |

|---|---|---|

| EBITDA (clean, adjusted) | High | Base for the multiple — but only if normalized properly |

| Owner dependency | Medium | If you leave, does performance collapse? |

| Growth story | High | Buyers pay for future upside, not just current margin |

| Operational clarity | Medium | Clean books = higher speed-to-close |

| Retention risk | High | Staff churn or weak associate bench = value haircut |

PE buyers are reducing exposure. If you’re central to performance, the multiple might still look high, but the payout will likely be back-weighted (earn-outs, holdbacks).

To get a reality check on where your EBITDA sits relative to current deal averages, understand the EBITDA benchmarks in vet practice sales to help you recalibrate before entering discussions.

Common Misreads That Cost Vet Practice Owners

- Mistaking revenue multiple for EBITDA multiple (they’re not the same)

- Assuming “12x” means 12x paid up front (it rarely is)

- Not asking how earn-outs are calculated

- Ignoring caps or clawbacks tied to post-close targets

If you don’t understand the structure, the valuation becomes irrelevant. It’s not what the buyer says, it’s what’s in the term sheet.

3 Deal Terms That Impact Your Valuation

- EBITDA adjustments: Buyers often “normalize” expenses, but those adjustments cut both ways. If they adjust in their favor, your valuation may drop during diligence.

- Rollover restrictions: That equity stake in the platform? It’s not always liquid. You may be tied in until their next exit or have limited say in outcomes.

- Performance metrics: If targets aren’t realistic (especially if you’re stepping back operationally), earn-outs can become unattainable.

In short, valuation is only half the picture. Structure decides if that number lands in your bank account or stays on paper. Before accepting any offer or selling your veterinary practice to a corporation, especially from a PE-backed consolidator or group, understand how the deal is framed.

What Changes After a PE Acquisition of Your Veterinary Practice?

For most clinic owners, the sale itself is planned down to the detail. What happens after rarely is. Yet this period (the post-PE transition) is where satisfaction rises or regret sets in.

If you’re considering a PE acquisition of your veterinary practice, understand this: the change isn’t just financial. It’s cultural, structural, and in many ways, personal.

You’re still the same person. But your authority changes.

You may still wear the same scrubs. You may walk the same floor. But you’re no longer the final call on hiring, vendor contracts, or pricing strategy. And that’s rarely spelled out during deal conversations.

The Most Common Shifts After a PE-Backed Sale:

- Performance is measured monthly, often using KPIs you didn’t track before

- Clinic meetings now include remote executives or require layered sign-offs

- Team morale fluctuates, especially when support staff feel unsure who’s “in charge”

- Budgeting becomes structured with centralized forecasting, sometimes quarterly

You’re not “losing control,” but you are entering a system built for investors. And that system needs predictability, reporting, and compliance more than it needs entrepreneurial flexibility.

The clinics that integrate best are those that planned for this in advance. They knew what role they wanted after the close. They set expectations with staff. They didn’t just sell, they transitioned.

What Actually Changes Even If Your Logo Doesn’t

| Category | Before PE | After PE Acquisition |

|---|---|---|

| Decision-making | You | Regional manager or board |

| Hiring authority | Local | Often centralized or tiered |

| Software & reporting | Optional | Mandatory & standardized |

| Purchasing autonomy | Full control | Contracted vendors |

| KPI tracking | Minimal | Monthly reviews and targets |

| Role clarity | Flexible | Defined expectations (esp. during earn-out) |

What many sellers underestimate is how much of the job becomes management. Even if you retain some autonomy, you’re now operating within a system built for scale, not for you.

Where Post-sale Issues Happen

- You’re asked to defend long-standing decisions to people who don’t know your clinic

- Protocols and vendor choices change, and not always for the better

- Staff relationships evolve, especially when long-time employees sense you’re no longer in charge

- Performance reviews become structured. They are tied to targets

These changes are not inherently negative. Many bring needed discipline. But the speed and intensity of change often catch owners off guard. This is why smart sellers spend just as much time preparing for post-sale integration as they do negotiating the offer.

If you’re thinking of selling, don’t just ask what the check looks like. Ask what your next 12 to 24 months will look like once that check clears.

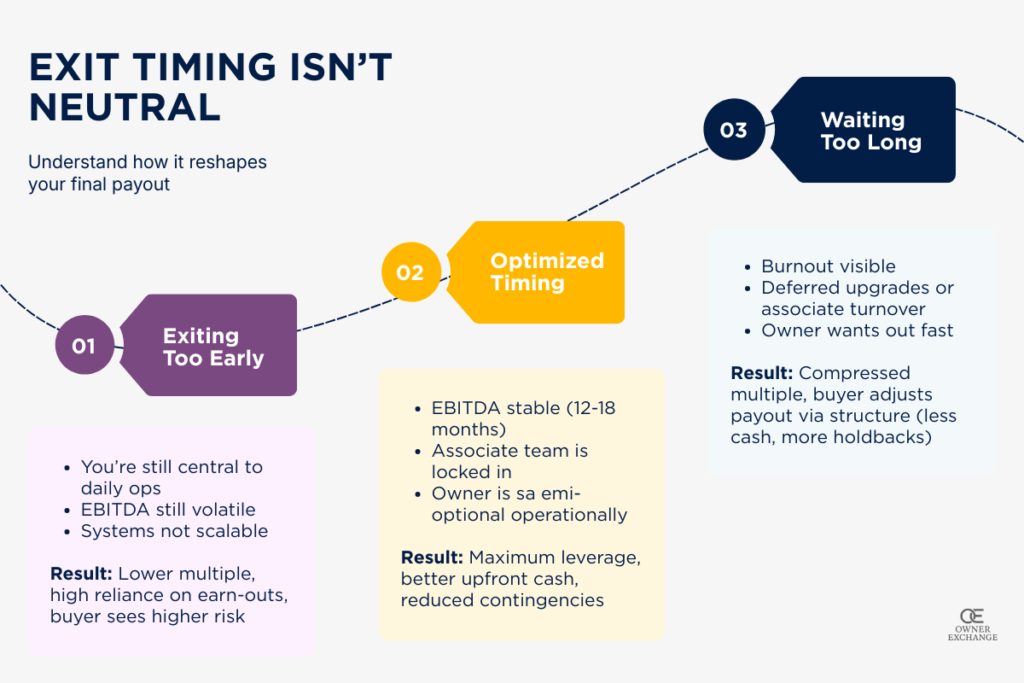

How Exit Timing Affects Your Payout in a PE-Backed Deal

Valuation multiples get a lot of airtime. But most owners don’t realize that the same clinic can be worth more or less, depending entirely on when it’s brought to market.

The impact of exit timing isn’t abstract. In private equity, it translates directly into how offers are structured, how aggressively buyers pursue your clinic, and how much of your payout is guaranteed versus contingent.

What Changes When Timing Shifts?

- Market appetite varies quarter to quarter. PE firms deploy capital on schedules tied to fund cycles. If your clinic hits the market when a buyer is hungry for a bolt-on in your region, you get lift. If you wait 6 months, that window might close.

- Buyers pay more when you’ve stabilized ops. Many owners chase higher EBITDA, assuming that growth unlocks better terms. But erratic numbers, even if up, reduce perceived reliability. A slightly lower but clean 12-month average can yield better offers than one big month that inflates your trailing figures.

- You lose negotiating leverage when too many others go to market at once. Multiples compress when supply floods the buyer pool. This happens more often than owners think, especially after tax code changes, interest rate shifts, or major group recapitalizations.

The Emotional Cost Of Waiting Too Long

What often erodes payout is internal fatigue. Owners who wait too long often:

- Accept less favorable terms just to get out

- Stop reinvesting in team or tech, which shows up in diligence

- Fail to prepare successors, weakening post-sale retention storylines

The owners who’ve exited well, including those in recent transactions like the Rarebreed Veterinary Partners sale, didn’t just pick a good moment. They got ahead of it. Their timing was proactive, not reactive.

If you’re even thinking about exiting in the next 12–24 months, now’s the time to define what needs to happen before you’re actually ready, not just emotionally, but structurally.

Why Your Payout Gets Reshaped Based On Timing

- Clinics sold at peak energy (team aligned, owner sharp, books clean) see more cash up front

- Clinics sold during transition (turnover, instability, fatigue) often shift to back-weighted earn-outs or equity swaps

- Buyers mitigate risk. And payout structure is their #1 tool

If you’re unsure where your practice is on the curve, don’t default to waiting. There may be no external sign that the window is open until it’s already closed.

Selling to Private Equity vs. Strategic Buyers: What’s the Difference?

The check might clear the same. The term sheet may carry similar language. But make no mistake, selling to a veterinary private equity group is structurally and culturally different from exiting to a strategic buyer.

And that difference becomes real not at close, but the moment your name leaves the ownership column.

What’s Driving Each Buyer?

A strategic buyer (like a national consolidator or DSO-style group) is typically in the business for the long haul. They’re buying infrastructure (talent, locations, relationships) to absorb into an existing system they plan to keep running. Their margin comes from scale and synergies, not from reselling the entity later.

On the other hand, PE buyers work off timelines. They’re often mid-way through a 5-7 year fund cycle and have specific targets to reach, which creates pressure. And pressure shapes decisions.

How That Difference Shows Up In Practice:

- Earn-outs are more common and more aggressive in PE-backed deals, often tied to stretch targets

- Decision-making moves faster under PE, but also feels more top-down

- Integration is structured under strategic buyers, often with playbooks built over years

- Exit control is limited in PE, so you’re entering someone else’s exit strategy

This is especially visible in transactions involving national players like NVA. In these NVA acquisition offers, sellers often report better transitions, but with less room to renegotiate roles after close because the system is already built.

Are You the Right Fit for a Veterinary PE Exit? Key Criteria to Assess

Private equity firms aren’t looking to buy your career; they’re looking to buy a business that can function as part of a scaled operation.

If your clinic still runs on legacy decisions, undocumented processes, or owner-led everything, it may perform well, but it’s not transferable. And that’s where deals fall apart.

Key Factors That Make Your Clinic Fit For a PE Exit:

- Operational readiness: The business has documented workflows, a clear org structure, and staff who know what to do without the owner stepping in

- Owner optionality: You can take two weeks off, and revenue won’t fall off a cliff. That’s a signal of maturity that PE groups look for

- Associate pipeline: PE buyers view associates as future growth drivers. If your bench is thin or unstable, your value takes a hit

- Cultural stability: Burnout, gossip, and confusion post-sale cost money. Buyers gauge clinic morale during site visits, even in casual conversations

When You Think You’re Ready, But Buyers Don’t

It happens more than most owners realize: you get approached, conversations move forward, and then it stalls. The numbers weren’t the issue. The structure was.

- Your systems weren’t auditable

- Your role wasn’t replaceable

- Your team wasn’t aligned

- The story didn’t scale

These elements aren’t always obvious to the seller, but they show up instantly in buyer conversations. Especially among firms focused on practice buyer profiles and demographics that match long-term portfolio goals.

Being “sale-worthy” to PE means you’ve built something predictable, transferable, and easy to integrate. You don’t need to be perfect. You just need to be prepared.

How to Vet a Private Equity Buyer Before Signing Anything

It’s easy to forget, especially when the offer lands fast, but you are not the passive party in a veterinary private equity deal. Just because a firm has capital doesn’t mean it’s the right fit. And once the ink dries, the consequences of choosing poorly can be felt for years.

Vetting a PE buyer is due diligence in reverse.

Start With What You Can See

- Fund age and timeline: Are you selling to a group at the start of their fund cycle or one racing to hit targets before recapitalization? If they’re under time pressure, the deal may close quickly, but support post-close might be thinner than promised.

- Track record in animal health: Not all PE firms understand the nuance of vet clinics. Ask who they’ve acquired, what went well, and what didn’t. Silence or vagueness is a red flag.

- Team background: Are you dealing with operators who’ve worked in healthcare or financiers who’ve never set foot in a practice? The tone of post-sale decisions often stems from who’s actually holding the operational reins.

Questions to Ask Before Saying “Yes”:

- What does post-close support look like, and who provides it?

- How many exits has your firm made in veterinary services?

- What happens if the platform underperforms in Year 2?

- Will I have a say in future bolt-on acquisitions in my region?

The goal isn’t to play defense. It’s to protect what you’ve built.

Most successful sellers lean on third-party insight. If you’re navigating multiple offers, this list of top-rated veterinary practice sales consultants can help you surface questions no buyer will volunteer on their own.

What To Look For and What To Probe Deeper On:

- Portfolio logic: Are you being treated as a bolt-on or a platform? That distinction matters. Bolt-ons often get less post-close support, more standardized systems, and less influence over regional strategy.

- Integration history: Ask them to walk you through a failed integration. If they can’t name one, they’re not being honest or haven’t done enough deals to know the difference.

- Leadership turnover: Ask how many former owners are still involved after 2 years. That’s a more useful signal than any “culture promise” in the pitch deck.

What the Best Sellers Do Differently?

They treat buyer evaluation like employee hiring. They take references. They ask the hard questions. They consult third parties who know what these deals look like from the inside.

If you’re navigating this without an experienced sounding board, these top-rated veterinary sales advisors have seen enough deal cycles to spot mismatches before they cost you leverage.

You don’t need to get this perfect. But you do need to know exactly who you’re handing the keys to and what that handshake commits you to, long after close.

Red Flags to Watch When Talking to PE Firms About Your Practice

The first few conversations with a veterinary private equity buyer are usually polished. You’ll hear about growth, partnership, and long-term alignment. But behind the language, there are cues (subtle, consistent) that tell you what kind of deal you’re really walking into.

The biggest regrets owners have post-sale aren’t about price. They’re about who they sold to, and what was omitted in those early talks.

Here’s what to watch for when a PE buyer starts courting your clinic:

🔻 They resist sharing platform-level details. If they dodge questions about how many practices they’ve acquired, how many owners stayed, or whether there’s a leadership layer above you, proceed carefully. PE buyers with strong track records are transparent. The rest talk in abstractions.

🔻 The integration plan is a black box. You ask what happens after close. They say: “We’ll figure it out together.” That’s not collaborative. That’s underprepared. If there’s no integration framework, you may be the test case.

🔻 Everything sounds too easy. No buyer with real operational goals says, “You can keep running things however you like.” That’s a setup for misalignment, especially if your systems conflict with theirs.

🔻 They deflect when asked about exits. You’re joining someone else’s investment cycle. If they won’t disclose where they are in their fund’s lifecycle, or what the next recapitalization looks like, you’re flying blind.

Owners burned in past corporate-backed veterinary deals often cite the same issue: the red flags were there, but got rationalized away. Your leverage exists before you sign. After that, you’re playing their game.

Test their clarity, not their charm. That’s what tells you whether they’re operators or just aggregators.

Pay Close Attention When You See:

- Generic answers about post-close roles. If they say “we’re flexible” or “you can be as involved as you want,” push back. Good buyers define expectations early. Vagueness = lack of plan or an unwillingness to commit.

- No mention of staff retention. If the buyer never asks about your team or brushes past associate retention, it usually means they’re focused on your numbers, not your people. That attitude will show up fast after close.

- Compressed diligence timelines. Urgency isn’t always a red flag. But if they’re pushing to skip details (“We’ll work that out later”) or want to move straight to signing, they may be hiding structural terms behind the speed.

- Overpromising on valuation. Be wary of buyers who casually float high multiples in the first call, especially without seeing your books. Strong offers come after diligence, not before. The too-good-to-be-true number is often a placeholder designed to pull you into exclusivity.

If you’ve followed recent shifts in corporate veterinary ownership models, you’ll see this pattern: early-stage charm, followed by rigid structure once control is handed over. Identifying that disconnect early is how owners avoid signing into a culture they’d never willingly work for.

Don’t just listen to what they pitch. Track what they avoid. That’s where the truth is buried.

What an Earn-Out Means in a Veterinary Private Equity Deal

In a veterinary private equity deal, the earn‑out is often presented as “additional upside.” In reality, it’s a risk‑sharing mechanism, and more often than not, the risk shifts toward the seller.

That distinction matters.

An earn‑out means a portion of your sale price is paid later, contingent on performance after the deal closes. On paper, it sounds reasonable. In practice, it ties your final payout to variables you may no longer fully control.

Why PE firms rely on earn‑outs:

Private equity buyers use earn‑outs to protect against uncertainty. If growth stalls, staff turnover increases, or margins tighten post‑close, they want insulation. Earn‑outs provide that buffer while keeping headline valuations attractive.

But here’s what’s rarely stated upfront: Once control changes, performance drivers change too.

Where earn‑outs break down for sellers:

- Targets are set on forward-looking assumptions, not historical reality

- Operational changes post‑sale (pricing, staffing, hours) can affect results

- Decision authority shifts, but accountability often doesn’t

- Timelines extending 18 to 36 months are common, even when the seller plans to step back

Many owners discover late that their earn‑out is tied to EBITDA metrics influenced by centralized decisions, not local ones.

A subtle but critical difference

In strategic acquisitions, earn‑outs are often short-term and narrowly defined. In PE-backed transactions, they’re frequently layered into broader portfolio goals, which means your clinic’s performance may be compared against others, not just itself.

You can see how this plays out in real-world pricing structures such as those outlined in recent PetVet transactions, where earn‑outs were used to bridge valuation gaps rather than reward outperformance. That context matters when reviewing a PetVet purchase price structure.

An earn‑out isn’t inherently bad. But unless it’s tightly defined, realistically benchmarked, and aligned with your actual authority post‑sale, it can quietly dilute what you thought you were selling for.

What to Expect in the Due Diligence Phase with a PE Firm

Once a term sheet is signed, the tone changes. The early conversations may have felt casual, exploratory, even friendly. But once you enter the due diligence phase with a veterinary private equity firm, the process becomes exacting. Every assumption gets tested. Every number gets unpacked.

It’s a structural shift and also the point where leverage begins to move from the seller to the buyer.

What Diligence Covers (and Why it’s Important)

It’s not just about validating EBITDA. PE firms are de-risking the deal:

- Financial hygiene: P&Ls, AR/AP, payroll records, trailing 12-24 month reporting: they’re not just checking for accuracy; they’re assessing the predictability of cash flow

- Legal exposure: Corporate structure, lease agreements, insurance coverage, employment contracts – weak points here delay or kill deals outright

- Operational viability: Staffing continuity, associate contracts, supplier dependencies, or anything that breaks post-close becomes a future cost to the buyer

Where Most Practice Owners Lose Momentum

- Books are “managed for taxes,” not for sale-readiness

- Staff turnover starts before the deal closes, raising retention risk

- Internal systems can’t produce what buyers need, slowing the process

- Ownership gets overwhelmed by the volume of requests, leading to delays that trigger renegotiation

Diligence is designed to extract clarity. And without experienced support, sellers often get buried in documentation and second-guessing.

That’s why many owners lean on professional veterinary practice transition services that help anticipate PE requirements and create internal readiness long before a term sheet lands. Know that if your diligence file isn’t airtight, you’re not just slowing the deal; you’re handing the buyer leverage without realizing it.

What Private Equity Firms Are Really Looking For

- Consistency: Have your financials held up quarter-over-quarter? Or did a good year mask a pattern of swings?

- Surprises: Are there deferred liabilities, employee issues, or off-book dynamics that weren’t mentioned early?

- Scalability: Can the business be plugged into an existing platform without major cost?

- Owner dependence: If you’re still driving every key function, the buyer needs to price in that risk, and they will

Diligence tends to surface these three problems:

- Underreported expenses mean valuation re-cut

- Employee misclassification or benefits issues mean a delayed close

- Missing or outdated vendor contracts mean forced renegotiations with contingency clauses

It’s not enough to “have documents.” The documents need to tell a story that the buyer trusts. Sellers who engage early with dedicated transition consultants tend to navigate this more smoothly.

They’ve already been through mock diligence, flagged exposure points, and staged their clinic for review. This kind of preparation is often invisible to outsiders but shows up in how smoothly deals move forward.

Conclusion

If you’re considering a veterinary private equity deal, don’t just think about what you’re getting. Instead, think about what you’re giving up. Control, continuity, and your role after closing all shifts, even in the best-case scenario.

The owners who exit well don’t wait for the perfect number. They move when their practice is ready, their team is steady, and the deal fits how they want to spend the next three years.

FAQs: Veterinary Private Equity

What veterinarian is owned by private equity?

It’s more common than most clients realize. Many practices now fall under large PE-backed groups like NVA, VetCor, and PetVet, even if the clinic name hasn’t changed.

How can I tell if my vet is owned by private equity?

You likely won’t see it on the sign. Clues include corporate branding on receipts, regional hiring ads, or pricing changes that reflect centralized control.

What is the 80/20 rule in private equity?

PE firms often find that 20% of practices drive 80% of returns. As a result, they double down on top performers and systematize the rest.

Melani Seymour, co-founder of Transitions Elite, helps veterinary practice owners take action now to maximize value and secure their future.

With over 15 years of experience guiding thousands of owners, she knows exactly what it takes to achieve the best outcome.

Ready to see what your practice is worth?