Veterinary Consolidation Trends 2026: What to Expect

Veterinary consolidation trends in 2026 are no longer projections; they’re unfolding in plain sight. Here’s data to back this statement.

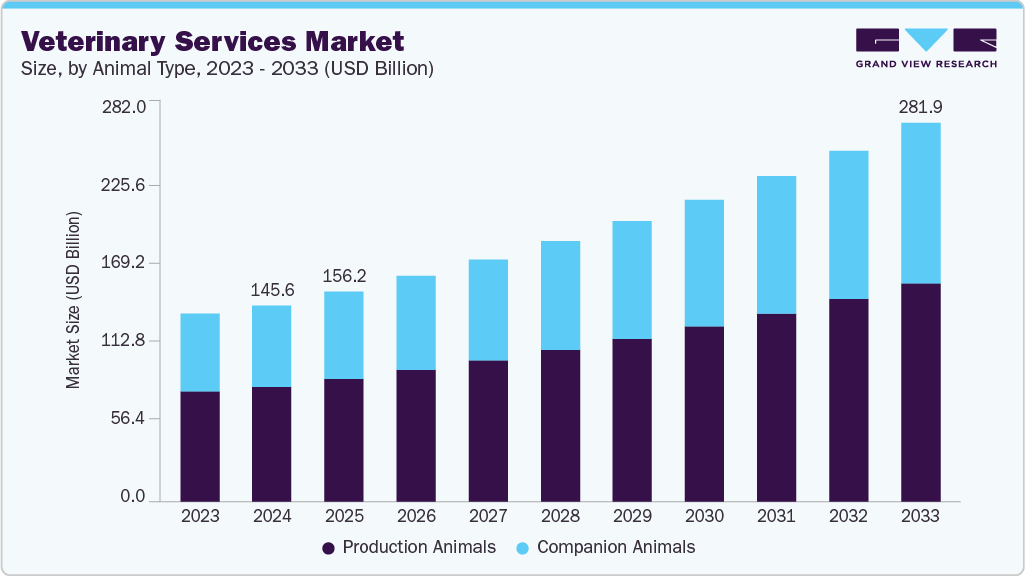

According to Grand View Research, the global veterinary services market is expected to surpass USD $145 billion by 2026, with practice acquisitions driving a significant chunk of that growth. For many independent practice owners, this influx of capital feels less like a windfall and more like a wave approaching shore: steady, forceful, and hard to ignore.

What was once a fragmented, relationship-first industry is now a battleground of buyer decks, compressed margins, and inboxes flooded with letters of intent.

The pressure to “exit before it’s too late” is real, especially for owners struggling with staff burnout, tech adoption fatigue, or post-pandemic expansion debt. But consolidation doesn’t always mean cashing out, or at the very least, not on someone else’s terms.

This blog explains what’s actually happening beneath; who’s buying, what they’re looking for, and how practice owners can move from reactive to strategic in 2026. If you’re wondering whether to sell, scale, or hold in 2026, this is your playbook.

What is Veterinary Consolidation and Why is it Accelerating?

| Veterinary consolidation is the transfer of clinic ownership from individual practitioners to scaled operators who view practices as long-term operating assets. |

Veterinary consolidation isn’t simply a surge in acquisitions. It’s a response to something deeper: ownership models that no longer match the weight of modern clinical and business demands.

Across regions, multi-doctor practices are being acquired—not because they’re failing, but because they’ve reached a scale that individual ownership can no longer support without outside infrastructure. Payroll, HR, compliance, tech, talent, all of it demands more than what one owner can manage sustainably.

What’s Really Driving This?

| Driver | Why It’s Important Now |

|---|---|

| Fatigue among owners | Emotional bandwidth is stretched too thin |

| Succession gaps | No clear path for younger vets to buy in |

| Compliance fatigue | OSHA, DEI, CE tracking, hiring – all intensifying |

| Shift in valuations | Exit multiples now reflect systems, not just size |

| Platform targets | Buyers race to hit DVM counts and geographies |

When consolidators assess a practice, they’re not just buying earnings; they’re buying time, scale, and pre-built teams.

Subtle Signs You’re Already in a Consolidator Lens

- Your EBITDA margin is healthy, but you’re not reinvesting in tech

- You’ve received more than one “partnership inquiry” in the last 6 months

- Your name has surfaced in peer networks as a “legacy clinic”

- You’re turning away new grads due to workload gaps

These are not random. They’re indicators that your practice has moved from a local business to a strategic asset. And in most cases, that’s when selling a veterinary practice becomes a conversation.

Also, understand that behind every sale is a pattern. Not of distress but of transition. Veterinary consolidation is less about clinics being absorbed and more about clinics evolving past what solo ownership can handle.

3 Things are happening at once:

- Owners are aging out faster than associates are stepping in

- Buyers have shifted from individuals to backed groups

- Clinic operations have outgrown spreadsheets and instincts

This isn’t a trend. It’s a reshuffling of how veterinary clinics survive long-term.

Let’s Break It Down: Why This Is Happening Now

- Consolidators aren’t just buying revenue. They want structured operations, leadership depth, and process stability.

- Banks are no longer the default path to ownership. Younger vets can’t afford to buy clinics outright, leaving a vacuum.

- Veterinary M&A has normalized. Sellers no longer feel the stigma of “selling out.” It’s a professional move.

- Platform-building has replaced standalone clinics. Consolidators build clusters.

Sample Transition Trigger Table

| You If… | Then You’re Likely a Target |

|---|---|

| Your payroll crosses $1M annually | Consolidator-ready |

| You manage 4+ FTE veterinarians | Operationally attractive |

| Your clinic serves >2 ZIP codes | Geo-scaling potential |

| Your staff tenure exceeds 3 years | Cultural fit advantage |

If any two or more of the above apply, you’re likely already being mapped into a buyout thesis, whether you’re aware of it or not. That’s why veterinary consolidation is accelerating: clinics are evolving, even if owners haven’t decided to.

How U.S. Veterinary Consolidation is Changing the Market Heading into 2026

Corporate buyers are still acquiring veterinary clinics at a steady pace, but the dynamics are shifting. What used to be a volume game is now a pattern game. Who gets bought, how they’re priced, and what happens after the deal has become far more nuanced.

Here are three key trendlines pulled directly from recent U.S. market data that explain where this momentum is going next.

1. Regional Density is Replacing Standalone Clinic Acquisitions

Early consolidation focused on acquiring strong individual clinics. That model is losing priority. Buyers are now underwriting acquisitions based on how well a clinic fits into an existing regional footprint rather than how impressive it looks on its own.

| According to Mansfield Advisors, corporate and PE-backed groups now control roughly one‑third of companion animal practices in the U.S., but a disproportionate share of recent deal volume has been concentrated in metro clusters where buyers already have infrastructure in place. |

What this means for the upcoming years:

- Clinics located near existing corporate hubs carry higher strategic value than isolated high performers

- Owners outside dense regions may face longer sale timelines or narrower buyer pools

- Valuation logic increasingly rewards “plug‑in ability” over individual clinic optimization

Consolidation is accelerating because buyers are completing regional puzzles.

2. Deal Structures are Tightening as Buyer Capital Becomes More Disciplined

The market still has capital, but it’s no longer deployed with the same tolerance for operational gaps. Buyers are protecting downside risk more aggressively, especially around staffing stability and owner dependency.

| According to the RL Hulett Pet M&A Update, a clear majority of recent veterinary transactions now include earn‑out components, post‑close performance conditions, or extended transition requirements, compared to earlier deal cycles that leaned heavily on upfront cash. |

What this means for the upcoming years:

- Fewer “clean exits” without post‑sale obligations

- Increased scrutiny on leadership depth beyond the owner

- Greater spread between headline price and actual cash received

Consolidation isn’t slowing, but the rules of engagement are changing. Owners who haven’t prepared operationally feel that shift first.

3. Independent Practices Are Not Declining. They’re Splitting Into Two Paths

Not all clinics are moving toward acquisition. Some are actively restructuring to remain independent, while others drift unintentionally into vulnerability. The difference is strategic intent.

| According to the Frontiers in Veterinary Science analysis, independent practices that adopt shared services, cooperative buying, or flexible staffing models show meaningfully stronger long‑term viability than independents that retain fully isolated ownership structures. |

What this means for the upcoming years:

- Independence is becoming a choice, not a default

- Buyers distinguish between “intentionally independent” and “structurally exposed” clinics

- Some practices will command interest precisely because they are not optimized for sale

This creates a bifurcated market:

- One track moving deeper into consolidation,

- The other is redesigning independence to survive outside it.

Clearly, what’s unfolding now is a reshaping of ownership structure that cuts across types of buyers, types of practices, and, more importantly, the motivations behind each acquisition.

One of the clearest shifts is the rise of selective acquisition logic.

Large corporate buyers are no longer simply collecting locations; they’re curating portfolios.

This means they’re applying filters not just to revenue or EBITDA, but to staffing ratios, appointment flow, leadership stability, lease terms, and client lifetime value.

Even among multi-site platforms, the 2026 mood will be cautious curation, not aggressive land grabs. Practices that would have been acquired “as-is” in 2022 may now need restructuring, associate alignment, or lease negotiation just to make it to LOI.

Here’s how that translates across deal types:

| Buyer Type | 2026 Acquisition Focus |

|---|---|

| Large Corporate (e.g., NVA) | Margin discipline, culture compliance, stability |

| PE-Backed Groups | Regional clusters, low-capex growth potential |

| Regional Roll-ups | Opportunistic buys, market density |

| Strategic (non-PE) Buyers | Talent pipeline, referral potential |

Many of these patterns are part of a broader shift tracked in detailed analyses of corporate vet clinic acquisitions. What used to be a fast-moving wave has now evolved into a set of controlled currents with some moving faster than others, but each responding to capital markets, local saturation, and operational risk.

For owners, the key is not to assume consolidation has passed or peaked. The reality is more nuanced. Activity is still strong, but it is just more calibrated. Some acquirers are pausing, others are pivoting, but few have exited the space entirely.

The big story of veterinary consolidation in 2026 is not about volume. It’s about precision.

Vet Industry Consolidation: What’s Different This Time?

What makes vet industry consolidation this year different isn’t just deal volume; it’s deal logic. Earlier consolidation cycles were driven largely by capital abundance and growth optimism.

Today’s environment is:

- More restrained

- More analytical, and

- Far less forgiving of operational blind spots

Buyers are still active, but the rules of engagement have changed in ways that materially affect independent practice owners. One major change lies in how value is defined. In prior years, top-line growth and historical EBITDA often carried disproportionate weight.

In 2026, buyers are dissecting value durability. They want to understand if current earnings can survive staffing changes, pricing pressure, and leadership transitions. This is why discussions around factors affecting vet practice value have expanded well beyond revenue and margin.

Buyers are now scrutinizing:

- Associate-to-owner dependency

- Schedule utilisation consistency

- Client revisit behaviour

- Wage growth relative to local labour markets

- Lease exposure over the next five to ten years

These weren’t ignored before, but they weren’t decisive. Now, they often are.

From the owner’s perspective, this has quietly changed expectations. Many practice owners are no longer asking, “How high can valuations go?” Instead, they’re asking, “What does a clean, defensible deal look like?”

Here’s how consolidation behaviour has evolved:

| Earlier Cycles | 2026 Reality |

|---|---|

| Speed-driven acquisitions | Diligence-driven acquisitions |

| Broad valuation bands | Narrowed, benchmarked ranges |

| Growth-first assumptions | Risk-adjusted modelling |

| One-size deal templates | Custom structures by practice profile |

Why This is Important Today:

The current cycle rewards foresight. Owners who understand what buyers now prioritise can decide when and how to engage without feeling rushed or reactive. This isn’t about timing the market perfectly. It’s about recognising that consolidation today is built on sustainability, not expansion speed. That distinction is what makes this phase fundamentally different from the last.

Corporate Ownership Trends in Veterinary Care: The 2026 Outlook

The ownership conversation in veterinary care has evolved. It’s no longer a question of whether corporate models will persist, because they already have. What matters in 2026 is how those models function, and more importantly, what trade-offs they demand from practice owners and their teams.

In prior years, many owners viewed a sale as a one-way transition. You hand over the reins, collect the payout, and adjust to whatever systems follow. But the modern corporate buyer, especially those backed by institutional capital, often doesn’t want a silent handoff. They want continuity. They want you involved.

This is especially true in private equity veterinary practices where operational efficiency is expected post-acquisition, but it must be driven from within. Top-performing platforms are no longer forcing owners out; instead, they’re structuring leadership retention plans, offering second bites of equity, and setting post-close milestones tied to local performance.

That may sound appealing, but it introduces new complexity.

Here’s what owners now need to evaluate:

| Consideration | What to Watch For in 2026 |

|---|---|

| Post-sale autonomy | Will your clinical input still matter? |

| Compensation structure | Is it salary-only, or hybrid with local upside? |

| Staff integration plans | Are you retaining hiring power for key roles? |

| Decision timelines | Are protocols going centralized or staying local? |

Corporate ownership today is about how the next 3 years play out. This is a crucial mindset shift.

For practice owners, the best outcomes will be driven by alignment:

- Clarity of roles

- Shared upside, and

- A structure that doesn’t erode what made the clinic thrive in the first place

Done right, corporate ownership doesn’t erase your identity. It can extend your legacy if you pick the right model, on the right terms.

The Future of Veterinary Mergers: What’s Next After PE Saturation?

It’s tempting to describe the current phase of veterinary mergers as “post-peak.” In reality, 2026 would mark the maturity phase, not a slowdown.

Capital is still present. Buyers are still active. What’s changed is the tolerance for friction. The next generation of mergers is being shaped less by ambition and more by execution risk.

One of the clearest indicators of this shift is how buyers now evaluate transition readiness. Deals no longer hinge solely on price and closing speed. They hinge on whether a practice can transition smoothly without operational disruption; a consideration that has pushed structured veterinary practice transition services into the center of modern deal-making.

The New Merger Priority Stack

In the coming years, successful mergers may tend to prioritize the following, in order:

- Leadership continuity during the first 12-24 months

- Associate retention and workload sustainability

- Client experience stability

- Systems alignment without abrupt standardisation

Financial terms still matter, but they no longer override these fundamentals. Buyers who learned the hard way during rapid expansion phases are now engineering mergers around transition durability.

What This Means for Owners Considering the Future

For practice owners, the future of veterinary mergers is less binary than before. The question is no longer “sell or don’t sell.” Instead, it becomes:

- What level of involvement makes sense post-transaction?

- How much change can my practice absorb without erosion?

- Which merger structures preserve operational rhythm?

This environment rewards preparation, not urgency. Owners who understand how mergers are evolving can evaluate opportunities without being pulled into false timelines.

The key insight this year is simple but powerful:

Veterinary mergers are no longer designed just to close; they’re designed to hold.

That shift changes everything about how owners should view the road ahead.

Who’s Still Buying: Strategic vs. Financial Buyers Compared

It’s easy to lump all buyers into the same category. Broadly speaking, buyers fall into two buckets: strategic and financial, and each brings its own mindset to the table.

Strategic buyers typically already operate veterinary businesses. Their interest is often driven by adjacency: a practice close to their existing locations, with a similar philosophy of care, strong staff retention, or complementary services.

Financial buyers, especially private equity groups, see practices as assets within a portfolio. They aren’t veterinarians. They’re investors. Their goal is to scale, integrate, optimize, and eventually exit.

While both types of buyers remain active, they’re not playing the same game. And they’re not looking at your practice the same way.

The Trade-offs at a Glance

| Aspect | Strategic Buyer | Financial Buyer (PE-Backed) |

|---|---|---|

| Primary Objective | Long-term operational control | Scalable growth + exit return |

| Integration Style | Slower, often customized | Standardized, process-driven |

| Owner Role Post-Sale | Often remains deeply involved | Usually transitions out within 12-36 months |

| Staff & Culture Retention | High priority, often embedded in the thesis | Prioritized but more fragile under scale pressure |

| Deal Speed & Complexity | Typically slower, more relationship-led | Faster, more model-driven |

A good example of the strategic playbook is Southern Veterinary Partners’ acquisition model. SVP has consistently pursued regional density, associate leadership, and slower integrations that don’t disrupt client experience or staff trust. For the right owner, that translates to stability and predictability.

By contrast, financial buyers are tightening their filters in 2026. They still acquire actively, but only where they can justify immediate margin expansion or bolt-on synergy. This changes the risk profile for the seller: upside may be larger, but so are the expectations.

Why is This Important Now?

In 2026, the best deals aren’t just about multiples. They’re about alignment. Understanding what each buyer type actually wants and how they behave once the ink dries is what allows owners to negotiate from clarity, not assumptions.

What Types of Vet Practices Are Still Attractive for Buyers?

The idea that “buyers will look at anything” no longer holds in 2026. Demand is still present, but it has narrowed around practices that demonstrate readiness for transition, not just sale. This is a subtle but critical distinction.

Buyers now assume that an ownership change will test a practice’s internal systems, leadership structure, and staff cohesion. As a result, the most attractive clinics are those that can absorb change without operational drag. This is where thoughtful veterinary practice transition services often come into play, helping practices prepare well before formal discussions begin.

What’s Actually Drawing Buyer Interest

Rather than focusing on growth narratives, buyers are prioritising continuity markers. These include:

- Clear delegation of clinical and non-clinical responsibilities

- Associates who are comfortable with decision-making autonomy

- Standardised workflows that don’t rely on informal knowledge

- Communication rhythms that keep staff aligned during change

In short, buyers want practices that won’t wobble when ownership evolves.

A different way buyers segment practices in 2026

Instead of “small vs large,” buyers increasingly segment practices like this:

- Transition-ready: minimal disruption expected post-close

- Transition-sensitive: solid fundamentals, but key dependencies remain

- Transition-fragile: performance tightly linked to one or two individuals

Only the first two categories tend to receive sustained interest. The third often requires preparatory work before serious offers materialise.

Why Does This Framing Benefit Owners

This shift actually works in the owner’s favour. It moves the conversation away from arbitrary thresholds and toward practical readiness. Owners who invest time in transition planning, even without immediate intent to sell, often find themselves with more options later.

In 2026, attractiveness is all about being transferable. Practices that can carry their identity, performance, and culture through change are the ones buyers continue to pursue.

What Makes a Vet Practice a High‑Value Acquisition Target?

By 2026, acquisition pricing in veterinary care reflects a clear buyer preference: certainty over complexity. High‑value practices are those that reduce unknowns, compress learning curves, and limit the operational surprises that can derail performance after a transaction.

This explains why two clinics with similar revenue can attract dramatically different interest levels. One may generate cautious outreach; the other may prompt competitive discussions. The difference often lies in how coherent the practice appears to an outside operator.

What Coherence Looks Like to Buyers

When buyers evaluate a practice, they’re not just reading financials. They’re interpreting signals:

- Does leadership extend beyond the owner?

- Are associates aligned with long‑term continuity?

- Can decision‑making happen without bottlenecks?

Practices that score well here feel easier to own. That ease translates directly into value.

Owners considering the path of selling a veterinary practice to a corporation often discover that the most attractive clinics are those that already function like part of a larger organisation without losing their local identity.

Key Attributes Buyers Consistently Reward

Here’s what tends to separate high‑value targets from average ones:

- Low owner dependency: Revenue isn’t tied to one individual’s presence

- Staff durability: Associates stay, grow, and accept responsibility

- Operational visibility: Metrics are timely and meaningful

- Client continuity: Relationships survive personnel changes

- Decision hygiene: Clear roles, fewer informal workarounds

These factors don’t just improve valuation discussions. They also shorten diligence cycles and reduce conditional deal terms.

| High value in 2026 is all about predictability. Buyers are willing to invest more where outcomes feel ‘knowable,’ and risks feel bounded. |

When Should Practice Owners Consider an Exit in 2026?

In 2026, the question of when to consider an exit has shifted away from age, burnout, or external pressure. For many practice owners, exit timing is now a strategic decision tied to optionality, not urgency.

The most thoughtful owners don’t ask, “Am I ready to sell?” They ask, “Am I positioned to choose?”

That distinction matters.

Exit conversations that begin from curiosity rather than necessity tend to unfold with more control, clearer boundaries, and better alignment. In fact, many of the strongest outcomes occur when owners explore options while fully capable of continuing ownership.

Signals That an Exit Window May Be Opening

Rather than a single trigger, exit readiness usually shows up as a cluster of conditions:

- The practice performs consistently without daily owner intervention

- Associates handle meaningful clinical and operational responsibility

- Financial reporting reflects how the clinic actually runs

- Growth no longer requires disproportionate personal effort

- Strategic interest from buyers begins to repeat, not surprise

These signals suggest the practice has matured into something transferable. Owners in this position often benefit from understanding what an exit could look like, even if no immediate decision follows. Resources addressing when to sell a vet practice increasingly emphasize this exploratory phase as a strength, not a commitment.

A useful reframing for owners

Exit timing in 2026 is largely recognising when leverage shifts. Owners typically have the most leverage when:

- Performance is stable

- Staff turnover is low

- No personal or financial pressure exists to transact

Waiting until one of those elements deteriorates often narrows options rather than improving them.

Exit consideration vs. exit execution

Considering an exit does not mean preparing to leave tomorrow. It can mean:

- Stress-testing the practice under new ownership assumptions

- Clarifying personal goals for the next 3–5 years

- Identifying what level of involvement feels sustainable

This measured approach allows owners to stay ahead of the decision rather than being pulled into it.

In 2026, the strongest exits tend to begin quietly long before they become urgent.

Conclusion

Not every practice owner is looking to sell in 2026. And that’s the point.

The current market doesn’t punish those who wait, it punishes those who ignore the shifts happening around them. Understanding how valuation works, what buyers are filtering for, and what options actually exist isn’t about making a decision tomorrow. It’s about making sure that when the time does feel right, you’re not scrambling to catch up. You’re choosing from a position of calm, not consequence.

In this phase of consolidation, awareness itself is leverage. And owners who build quietly, document clearly, and lead intentionally are the ones who’ll have the most to negotiate with, whenever they decide to have that conversation.

FAQ: People also ask for

What is the future of veterinary?

What’s becoming clear in 2026 is that ownership models are fragmenting. Some clinics are joining regional platforms. Others are doubling down on independence. And many are reworking how leadership and care delivery coexist without burning out the people behind them. As client expectations rise and operational friction stacks up, practices built on clean systems and stable teams are the ones likely to thrive. This isn’t a story of corporate takeover. It’s a shift toward structure that supports sustainability.

What is the rule of 20 in veterinary care?

The “Rule of 20” refers to a financial benchmark that combines profitability, labor efficiency, and revenue growth into a single performance snapshot. For years, it was treated like a health check. In 2026, it still matters but it’s not the dealmaker it once was. Buyers now view it as a starting point, not the full picture. A practice might miss the Rule by a few points and still draw offers if it runs consistently, isn’t owner-dependent, and has stable staffing. It’s not about hitting a number. It’s about proving your clinic functions like a business, not a hustle.

What is the biggest issue facing veterinary medicine today?

Many owners are still holding everything up themselves: hiring, scheduling, clinical load, compliance, payroll. That model is cracking. In 2026, the pressure comes not from a lack of opportunity but from too many responsibilities resting on too few shoulders. The challenge now is building practices that don’t fall apart when one person needs a week off. Whether an owner stays or sells, the core risk is the same: nothing sustainable happens when the entire system relies on one person being invincible.

How do you envision the role of veterinarians evolving in the next 10 years?

Clinical care won’t disappear, but the role around it will stretch. Over the next decade, veterinarians are likely to lean into leadership, not just with clients, but within their teams. More will shift away from owning everything and toward leading something, whether that’s mentoring junior vets, shaping clinical protocols, or stepping into strategic roles inside group practices. Ownership will remain a path, but it won’t be the only one. As business complexity increases, vets who know how to lead without needing to control every moving part will find themselves with more options and less burnout.

Melani Seymour, co-founder of Transitions Elite, helps veterinary practice owners take action now to maximize value and secure their future.

With over 15 years of experience guiding thousands of owners, she knows exactly what it takes to achieve the best outcome.

Ready to see what your practice is worth?